HUMAN's Iris Report: Marketers' Perceptions of Brand Safety and Viewability Tools

Introduction

Brand safety and viewability have long served as the foundation of trust in digital advertising. But as the media ecosystem has become more fragmented, dynamic, and complex, that trust has been broken time and time again.

Marketers are asking harder questions of the tools they rely on to protect their investments and reputations.

In July 2025, HUMAN surveyed 50 senior marketing leaders from a broad range of industries and company sizes about their use and perception of brand safety and viewability platforms. The goal: to understand how—and, indeed, whether—today’s verification tools are meeting marketers’ evolving expectations.

The results reflect a landscape in transition. While verification technologies are firmly embedded in most advertising workflows, many marketers feel they are no longer fit for purpose in an omnichannel world. Confidence in traditional media remains high, but satisfaction drops significantly in emerging channels like connected TV, in-app, and in-game environments. Respondents cited a desire for smarter controls, clearer reporting, and a more meaningful connection between verification metrics and business outcomes.

What emerges is a call for reinvention.

This report offers a snapshot of what marketers believe success should look like in the next chapter of verification: one defined by context, impact, and transparency.

Survey Methodology and Demographics

The findings in this report are taken from a July 2025 survey of 50 senior marketing leaders with a self-reported firsthand knowledge of their organization’s brand safety and viewability tools.

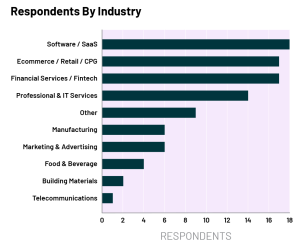

Respondents to this survey work at organizations across a wide variety of industries:

Figure 1: Respondents’ self-identified industry (respondents could choose more than one industry)

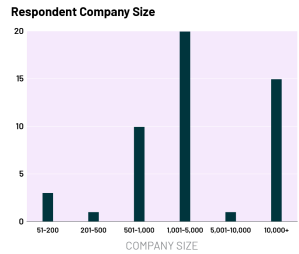

Respondents also worked at organizations of a wide variety of sizes:

Figure 2: Respondents’ self-identified company size

Executive Summary

In an increasingly complex media environment, ad verification has become foundational to building confidence in digital advertising.

Yet many marketers question whether today’s brand safety and viewability tools are keeping pace with the needs of modern media strategies, especially as spend shifts into emerging environments, such as CTV, audio, in-game, and more. To understand how advertisers are navigating this evolving landscape, we surveyed 50 senior marketing leaders across a range of industries and company sizes. All respondents had direct experience with brand safety and/or viewability platforms. Their feedback paints a picture of progress, but also of growing gaps.

Marketers hold clear, nuanced views about what success looks like:

- Brand safety is no longer just about blocking bad placements; it’s about protecting brand equity through contextual alignment and values-based suitability. Success means appearing only in environments that are not just “safe,” but appropriate.

- Viewability is evolving past percentage-based metrics. Marketers now define success as genuine human exposure: was the ad able to be seen, for long enough, by the right person, in the right place?

These definitions reflect a more mature understanding of verification’s role, not just as a check the box solution, but as a critical contributor to campaign quality.

While respondents expressed moderate satisfaction with tool performance in traditional channels (e.g., web, linear TV), confidence sharply declined when discussing emerging formats like connected TV (CTV), in-app, and in-game environments.

This decline points to a widening verification gap. Tools built for one era are being stretched into another—often with limited transparency, blunt controls, and inconsistent reporting.

When asked about their biggest challenges, respondents identified three recurring pain points:

- Lack of transparency and actionable reporting, especially in fast-moving environments.

- Over-reliance on keyword blocking, which limits reach and can misclassify suitable content.

- Limited support for non-traditional inventory, including influencer content and social platforms.

These limitations have real consequences. Marketers cited impacts including wasted internal resources, rising media costs, brand sentiment erosion, and even customer churn… all stemming from verification blind spots.

This research reveals a verification stack under strain. As advertising continues to fragment across channels, marketers are demanding more: better context, smarter controls, clearer diagnostics, and faster feedback loops.

The takeaway is not that verification is broken, but that it’s ripe for reinvention. Solutions that can adapt to emerging environments, restore transparency, and deliver on advertisers’ evolving definitions of success will be well-positioned to lead the next chapter of responsible media.

How Marketers Define and Measure Success Today

Respondents were asked to define, in their own words, what success means to them with respect to their brand safety and viewability tools.

These definitions then formed the basis for follow-up questions about how their current brand safety and viewability partners performed up to standards, both on traditional media (which we defined as linear TV, and web display/video), and on new and emerging media (which we defined as connected TV, audio, in-game, and in-app).

Brand Safety

On its face, defining success with brand safety seems like a straightforward exercise. If the promise of a brand safety tool is to protect the brand from associations with potentially harmful publisher content, then a successful brand safety experience ensures ads consistently appear in environments that protect brand equity and align with suitability standards, while avoiding harmful or inappropriate content.

Respondents’ perspectives on brand safety success were largely aligned with one another:

In one sentence, how do you define success with brand safety?

“Our ads are only shown in brand-appropriate environments, and adjacent to relevant content as per our specific guidelines and defined restrictions.”

“Ensuring we have prevented our ads from appearing in inappropriate places or alongside inappropriate content.”

“Protecting a brand’s reputation and keeping it from appearing in unsafe environments or in places contrary to the brand’s identity and reputation.”

One of the most common buzzwords among responses to this question was reputation. Marketing leaders are fixated on the reputation of their brand and how that subjective perception, especially relative to the publisher on which an ad appears, can shift following a brand safety failure. And that bears out in other research: the reputation of a publisher was the joint top reason for advertisers reducing spending, according to a report by Advertiser Perceptions.

An interesting comment suggested brand safety partners should be proactive and intuitive with their decisions:

“Our ads should not show up near highly sensitive or highly polarizing content —this should happen even without explicit guardrails”

The idea of more intuitive, context-aware brand safety came up several times in the survey, both in how respondents defined success with their partners and also in how those partners fell short. This dovetails with the idea of brand suitability, another common theme among several respondents.

Some respondents went so far as to reference internal suitability guidelines:

“If we achieve desired metrics and we align with our suitability frameworks, we know we are succeeding.”

The distinction between brand safety and brand suitability can be a muddy one, and scaling and automating tools to achieve brand suitability frameworks requires a significant focus on context and tone analysis.

As to how respondents felt current brand safety partners met their personal definitions of success across both traditional and new/emerging media, the results had a distinct shift:

Figure 3: Respondents’ subjective assessment of how well brand safety tools met their needs on traditional media (scale 1-5)

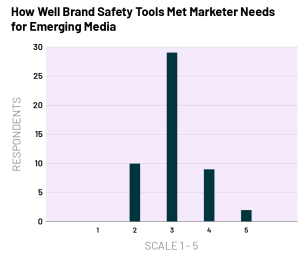

Figure 4: Respondents’ subjective assessment of how well brand safety tools met their needs on new/emerging media (scale 1-5)

On the whole, respondents felt their brand safety tools better met their expectations and definitions for success on traditional media than on new and emerging media. With the signal challenges inherent in collecting information on many new and emerging media platforms, this outcome isn’t surprising, but it does underscore the need for new thinking on brand safety in these environments.

Viewability

Defining success with viewability, too, feels intuitive: were my ads not just rendered, but actually visible and understandable for a meaningful amount of time on the page? A successful viewability partner, then, measures whether ads met visibility thresholds including how much of the ad was visible and for how long.

Respondents’ thoughts on viewability success included ads’ visibility, but branched in some other directions as well:

In one sentence, how do you define success with viewability?

“The ability for the consumer to see at least 50% of the ad for longer than 2 seconds.”

“When our advertising appears prominently adjacent to premium content and not buried or difficult to view by consumers on a consistent basis.”

“A combination of execution (design, accessibility) combined with optimizing exposure for maximum impact and reach; and strategy, ensuring content is optimized to hit minimum ad pixel exposure rates, video completion rates, and frequency targets.”

“Ensuring the ad is clearly legible and loads properly for the viewer and it was delivered.”

“Our ads are shown in an area of the page that is seen by the majority of visitors and is not buried down on the page or served through intrusive pop-ups or plug-ins.”

“Our ads are actually seen by real people in the right place and time to make an impact, not just technically delivered.”

Several respondents highlighted the placement of ads as a key metric for success. Ads that were “technically viewable” but below the fold on the page, or which served through pop-ups, were broadly perceived as less desirable even if they met the criteria for viewability.

“Our assets are consistently represented accurately and accessibly to all without any issues.”

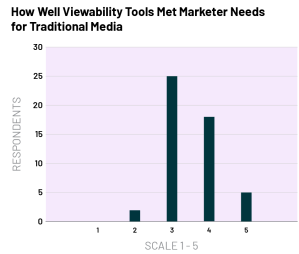

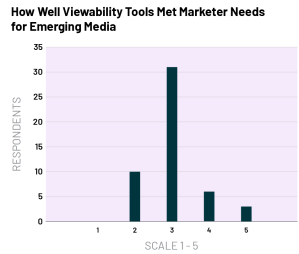

When asked whether their viewability partners met their definition of success, most respondents felt stronger about their viewability partners on traditional media than new and emerging media:

Figure 5: Respondents’ subjective assessment of how well viewability tools met their needs on traditional media (scale 1-5)

An outright majority of respondents (31 of 50) rated their viewability partner only as average at meeting their definition for success on emerging media, and half rated their viewability partner as only average on traditional media.

Figure 6: Respondents’ subjective assessment of how well viewability tools met their needs on new/emerging media (scale 1-5)

Current Gaps and Business Impacts

Respondents were also asked to share what brand safety and viewability needs they had that weren’t being met, and what business impacts they had experienced as a result of brand safety or viewability failures.

These business impacts run the gamut, from internal resource drains to increased media spend to customer churn, underscoring that these tools play a crucial role in digital advertising.

Brand Safety

One key theme to respondents’ answers about unmet needs with brand safety efforts and tools centered on the technology’s inability to solve for every possible issue on every possible platform. This is especially true for marketing teams with broad approaches, including influencer and social marketing, walled gardens, and new and emerging platforms like audio and in-game.

What is the biggest gap or unmet need you face with your brand safety partner(s)?

“One of the biggest gaps is the ability to manage certain influencers.”

“Maybe with something like ChatGPT which is beyond our control.”

“Coverage across emerging channels like connected TV (CTV), in-game environments, and in-app inventory. Our current partner performs well on traditional digital placements, but lacks precision and transparency in these newer, high-growth areas.”

“Keeping up with technology and emerging AI risks.”

“Lack of reporting and clear visibility into where my advertising is appearing.”

“For emerging channels, a better understanding of how they will control for brand safety.”

AI, too, was a recurring theme in respondents’ answers. There’s a great deal of confusion and concern over how generative and/or agentic AI will impact the digital advertising ecosystem.

“Making sure they are staying ahead of the curve on ad fraud with AI (on made for advertising sites) and helping us accurately track performance on connected TV advertising, there is limited visibility in how this channel performs.”

This threat model—using AI to generate and monetize low-quality websites—is one HUMAN explored recently.

Lastly, the idea of context came up several times in respondents’ answers. Many respondents expressed a concern that static blocklists or keyword-based approaches to brand safety were leaving brand-safe inventory on the table.

“Most tools still rely on generic blocklists instead of letting us define nuanced brand suitability standards by audience or campaign.”

The need for more context-aware brand safety approaches follows on earlier comments about brand suitability as respondents defined what success with a brand safety tool might look like.

Viewability

On the viewability front, the most common answer was a need for greater transparency and visibility into how viewability tools work and what they deliver.

What is the biggest gap or unmet need you face with your viewability partner(s)?

“Lack of visibility and transparency into where our ads are actually running.”

“Would like more detailed information on viewability and engagement with corresponding conversion rates.”

“Inability to connect viewability metrics directly to meaningful business outcomes.”

“Viewability doesn’t necessarily equal attention. People could be multitasking.”

“I don’t know if my view is a quality view, and I don’t believe that time viewed can really be an indicator of that.”

“Much of the time, we are taking their word for it that all the ads are viewed correctly. With so many formats and new platforms and updates, it is impossible to manage with the in-house team.”

Many respondents shouted out actionability as a missing component of their viewability solution. Metrics alone aren’t enough; marketers want actionable, explainable insights that help them optimize in real time:

“While the tools provide us with data and numbers, they do not allow for an easy way to quantify the impact and take action to ensure makegoods on poor placements and viewability.”

This echoes a common concern/complaint among marketing teams: connecting activity at the very top of the marketing funnel to active engagement with the brand.

Attention is another place where respondents felt viewability partners fell short:

“Understanding attention and engagement with an ad, beyond meeting the standard SLA on viewability.”

This concern came up several times in respondents’ answers. It’s difficult to understand the relationship between an ad’s visibility and a user’s engagement with that ad. That, in turn, makes it a challenge for marketing teams to justify the need for a viewability partner:

“These types of services (and the associated metrics) feel new and untested, and the partners don’t offer a whole lot to help me offset this bias.”

Helping organizations better understand what viewability metrics actually mean will be key going forward.

Business Impacts

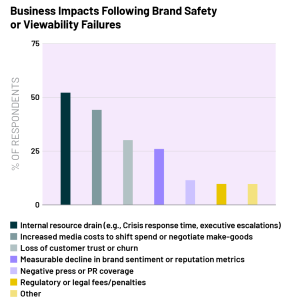

But what does a failure on either side actually cost a business? We asked respondents what specific impacts they’d experienced in the past twelve months as the result of a brand safety or viewability failure, and the results spanned a wide range of possible outcomes:

Figure 7: Respondents’ experienced business impacts following brand safety or viewability failures (respondents could choose more than one impact)

Half of the respondents reported an internal resource drain as a result of a failure, and just short of half experienced increased media costs. But a solid 30% of respondents experienced a loss of customer trust or an outright customer churn, and 26% suffered a measurable decline in brand sentiment.

These aren’t small issues—losing customers and spending time and money mitigating problems and backlash to account for failures in brand safety or viewability have massive downstream effects on marketing planning, which in turn affects the company’s ability to forecast.

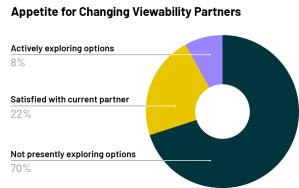

Considering Change

Finally, respondents were asked for their perspective on whether they had the appetite for a change in partner for both their brand safety and viewability tools. Making a shift in these technologies is no small task—campaigns and creatives need to be revised to accommodate new tags and SDKs, a time-consuming process. But despite how daunting a shift might be, the vast majority of respondents were at least open to considering a change:

Figure 8: Respondents’ appetite for changing brand safety partners

Figure 9: Respondents’ appetite for changing viewability partners

A full 78% of respondents were actively pursuing or willing to consider a change in their brand safety partner, underscoring the broad dissatisfaction highlighted in the qualitative responses above. The same percentage of respondents—78% of the total— were similarly actively pursuing or willing to consider a change in their viewability partner.

A New Approach

The above findings, and in particular the appetite-for-change figures, all point toward one underlying truth of companies’ experience with brand safety and viewability tools: there’s a willingness to explore a new approach to brand safety and viewability, one that emphasizes not just the performance numbers, but the process by which they were reached and the opportunities they reveal.

One key takeaway from this research is that marketers want more contextual awareness in their brand safety and viewability tools. It’s not enough simply to block based on a URL, keyword, or title tag—a level of nuance is required to understand the tone of the content at the level required to make an informed block-or-not decision.

But it’s not just the content that needs extra context for better-informed decisions. The publisher itself and the origin of the content both come into play. While many advertisers shy away from “made-for-advertising” websites, others find value in those publishers. And while some advertisers are wary of the role AI has begun to play in digital advertising, others are less reticent and would welcome the opportunity to associate their brand with AI-generated content.

“AI is a growing threat. We don’t know enough about the scale of the potential threat yet. Every day we are learning and assessing where we are in our maturity and what we need to do to protect our assets.”

“I think there is a lack of context in how we implement the safety standards leading to having more content in the gray area or leading to blocking more content due to lack of contextual understanding.”

Which leads to the second key takeaway: a new emphasis on transparency, particularly with viewability. Many respondents shared frustrations about the opacity of metrics and the inability to connect those decisions to business outcomes. And if that transparency could be focused not just on whether an ad was theoretically viewable but instead on whether the ad was engaged with, that would justify the cost of the solution and validate campaigns’ performance much faster.

“It’s hard to measure attention metrics which can be useful in determining our success better since viewability does not mean attention.”

“It’s hard to measure attention metrics which can be useful in determining our success better since viewability does not mean attention.”

Finally, and perhaps most tellingly, respondents want an approach with greater reporting and speed. This is distinct from the need for transparency—while that answers the “why”, reporting and speed offer greater answers to the rest of the five w’s.

“Reporting and new product assessments. I am unsure if allow and block lists are being adequately implemented. An unmet need is regular risk assessment given new platforms and increased audiences online.”

“Ensuring confidence that our ads are reaching our goal consumers/audiences and not wasted or unseen. Need instant feedback on our ads and how we can optimize them to reach and increase views.”

This new, insights-driven approach can be the key to unlocking the value of brand safety and viewability tools as a central component of a digital advertising suite.